Open data lessons from pioneering bank Groupe BPCE

Open data is a fast-growing trend in banking. But what are the use cases, benefits and challenges? We asked open data pioneer Yves Tyrode of Groupe BPCE to explain more at our Data on Board conference.

Yves Tyrode is Chief Executive Officer in charge of Innovation, Data, Digital, and Payments at Groupe BPCE as well as the President of Oney Bank. When he arrived at Groupe BPCE, Tyrode was first tasked with the group’s digital transformation and then later with its data transformation.

Groupe BPCE is the second-largest banking group in France, active in retail banking and insurance through its two major banking networks, Banque Populaire and Caisse d’Epargne.

Yves Tyrode’s journey with Opendatasoft began ten years ago at rail operator SNCF. At the time few enterprises were opening up their data, which gave him the chance to take part in the very first data strategies, identifying the obstacles and challenges to overcome. In retrospect, Tyrode believes that this early experience with open data was of pivotal importance as it gave him the opportunity to become a pioneer in the area..

We invited him to the Data on Board 2021 conference so he could share more about Groupe BPCE’s open data initiatives. In this article, we’ve highlighted some of the key lessons from his keynote speech: Public data, private data: Responsible data serving business.

View the recording of Yves Tyrode’s keynote here:

Groupe BPCE: A data pioneer in its sector

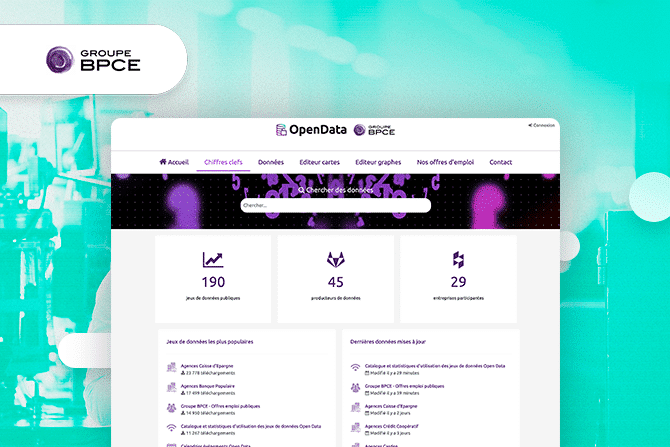

Groupe BPCE launched its first open data portal in 2017, as part of its digital transformation strategy. The aim was to make it easier for customers, employees, and partners to access public data. It was the first French banking group to make its datasets available to the general public.

This pioneering move was not driven by any regulatory requirement or in response to any competitor activity. It was instead driven by an understanding of the benefits open data could provide.

Today, Groupe BPCE has 175 public datasets available free of charge to analysts, journalists, researchers, teachers, students, open data players, local communities, chambers of commerce, transport companies, start-ups, and employees.

Groupe BPCE is thus able to create value by making its public data available to everyone, moving the whole open data field forward. The initiative was welcomed by the community, and many experts recognized its long-term benefits.

The group’s data teams also meet regularly with other players in the open data ecosystem and actively participate in meetups to discuss issues and build original models that create value.

What use cases exist in the banking sector?

Groupe BPCE has implemented a number of projects to share its information as open data. During his keynote, Yves Tyrode focused on two particularly successful use cases:

Creating a tourism ecosystem using payment data from foreign visitors

With all the payment data available to Groupe BPCE, we have the ability to measure credit card spending by foreign tourists, including understanding the number and amount of their transactions, broken down by their country of origin and where they were visiting.

Groupe BPCE has completely anonymized this data so that it can be used as open data by France’s regional departments. This gives them deep insights into their visitors and helps them set the strategy for attracting future tourists.

Posting the group's job openings in real-time through open data

This second example of how we’re using open data has a direct benefit for the organization. We’re using open data to post all Groupe BPCE job openings, with automatic updates four times a day, in formats that anyone can access and easily reuse from a simple spreadsheet or API.

Groupe BPCE is the first banking group in France to do this, and it allows all stakeholders to reuse data and filter job searches by location, city, employment sector, job type, and more.

This way, Groupe BPCE benefits from a reliable, sustainable solution for posting its job openings, while also attracting higher quality candidates. Today, companies must be able to leverage the right resources to attract digital-first, data literate talent.

What lessons have we learned?

Above all, Yves Tyrode explains that applying business expertise is essential if organizations are to highlight impactful data projects that deliver high added value.

Drawing on his experience in the field of data, Tyrode provides three takeaways for a successful enterprise data sharing strategy:

Cultivate high quality data

Groupe BPCE invests heavily in the quality of its data.

Create progress through open data

The second crucial point when setting up data projects is that opening up data to the outside world creates additional value.

Tyrode recalls the difficulties experienced when Groupe BPCE was just starting to open up its data. “Opening APIs in an information system is extremely complicated because IT departments are afraid to open their system, particularly due to cybercrime, which is a very real concern. Openness is necessary, but it must be done in a way that protects customers and data alike.”

Focus on the benefits to end users

The last point Tyrode raised is the importance of always thinking about end-users when setting up data projects.